California Bill Aims to Simplify Insurance Payouts After Disasters

A new California bill would require insurers to pay homeowners 100% of their coverage for belongings lost in natural disasters, removing the need to itemize possessions.

Premier Private Client Insurance Services, a Trucordia business, is an independent, full-service insurance brokerage and consulting firm specializing in custom-tailored insurance programs to protect high net worth clientele from the unique risks associated with valuable assets. Through highly personalized service and 25 years of unparalleled industry expertise, we vow to bring you an insurance experience that is Anything but Ordinary.

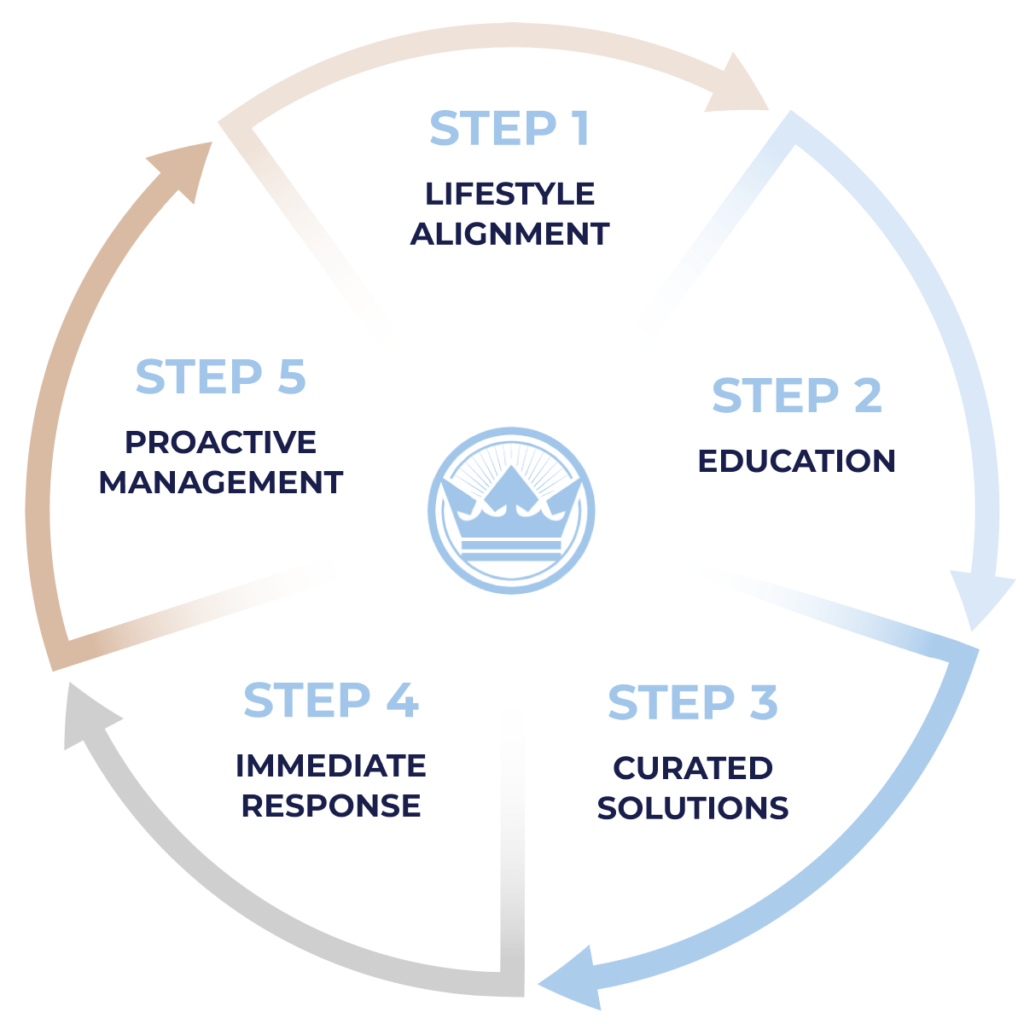

How do we design superior insurance solutions that fit our clients like a glove? The answer lies in our Premier Lifestyle Risk Assessment.

How do we design superior insurance solutions that fit our clients like a glove? The answer lies in our Premier Lifestyle Risk Assessment.

We need a full-bodied view of your lifestyle in order to design a solution as unique as you are. You can expect us to ask in-depth questions about your goals, family structure, and your assets.

We prioritize insurance education, articulating every outcome that could possibly impact your risk profile. Our goal is to provide absolute transparency so that you are never surprised.

Our team will handcraft an insurance program that aligns with your individual needs and considers your means, rather than putting you in a box with everyone else.

In the event of a claim, our team is poised and ready for action. Bad things can and do happen. But you can rest easier knowing that we will be your advocate every step of the way.

Life changes, and so should your insurance. Our team will continue to evaluate your program throughout the year, reporting marketplace changes and communicating our suggestions.

Our first call was to Premier…The processing of our insurance claims and obtaining reimbursements could not have gone smoother. Because of their responsive and efficient efforts, my family was able to get back into our home and back to normal without the difficulties and delays experienced by many of our neighbors.”

Jay S

A new California bill would require insurers to pay homeowners 100% of their coverage for belongings lost in natural disasters, removing the need to itemize possessions.

Having a “go bag” ready before an emergency strikes is critical. Here’s a breakdown of what to consider packing.

The growth of homes in the wildland urban interface played a role in the catastrophic Los Angeles wildfires. Millions of Americans face similar danger.

To request more information or to set up a complimentary Premier Lifestyle Risk Assessment, please complete this form and a Premier Private Client Advisor will contact you shortly.