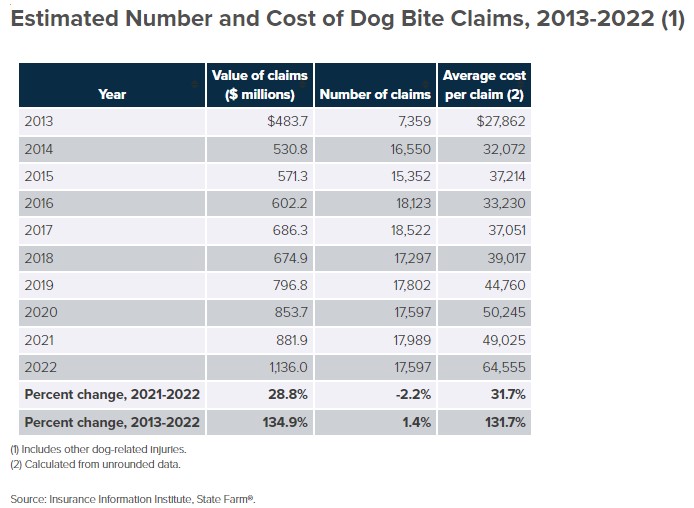

Dog bites can result in serious injuries, and in some cases, they can even be fatal. While the overall number of dog bite injury insurance claims dropped in 2022, the costs increased as insurers paid out more than $1 billion.

According to the Insurance Information Institute (Triple-I) and State Farm, the total cost of dog-related injury claims increased 28% from $882 million in 2021 to $1.13 billion in 2022.

The average cost per claim was $64,555 in 2022, a 31.7% increase from $49,025 in 2021, according to the data.

Looking back, the average cost per claim more than doubled between 2013 to 2022, as medical costs, settlements, judgments, and jury awards given to plaintiffs have surged.

The Triple-I and State Farm estimate more than a third of the dog bite injury claims in 2022 were filed in five states: California, Florida, Texas, New York, and Michigan. California had the highest average cost per claim at $78,818.

In 29 states, dog owners are liable for injuries caused by their pets, with some exceptions.

Homeowners’ and renters’ insurance policies typically cover dog bite liability legal expenses up to limits typically between $100,000 and $300,000.

However, some insurance companies will not insure homeowners with dogs categorized as “dangerous.” These breeds are often excluded from coverage because they are perceived to be more aggressive and have a higher likelihood of causing injury.

Among the top dog breeds that insurance companies exclude from homeowners’ policies are Pit Bulls and Staffordshire Terriers, Rottweilers, German Shepherds, Doberman Pinschers, and Siberian Huskies.

If you’re a dog owner, it’s crucial to check with your insurance provider to see if your dog is covered under your policy.

In some states, including Pennsylvania and Michigan, laws prohibit insurers from canceling or denying coverage to owners of particular dog breeds. Additionally, some insurance carriers will make decisions on a case-by-case basis.

Talk with a trusted insurance advisor if you have questions about your pets.