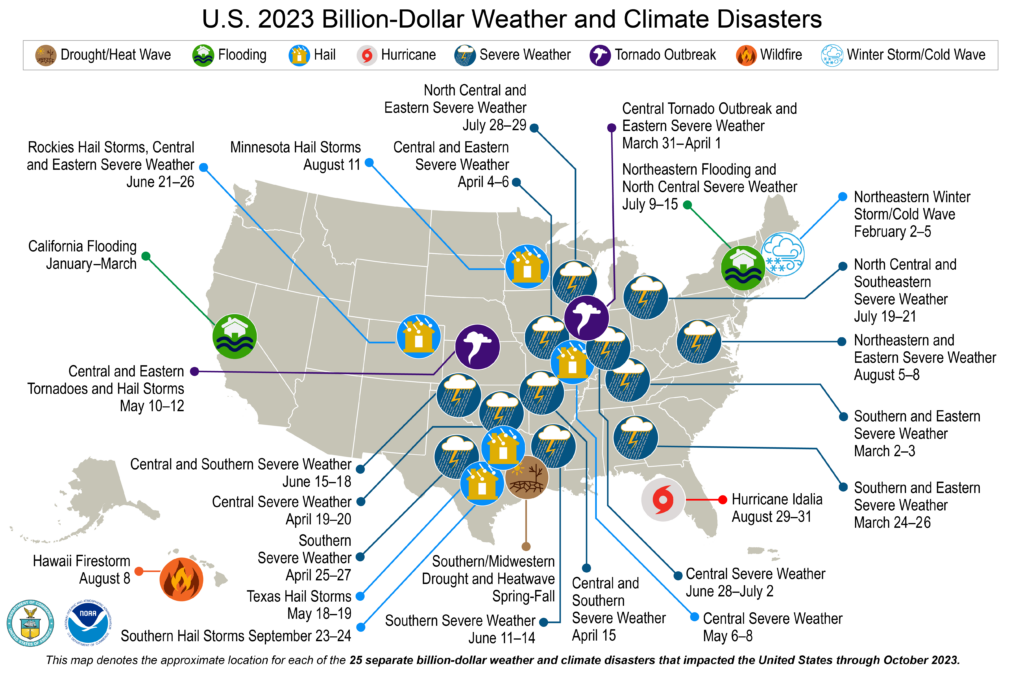

With a month and a half left in 2023, the U.S. has experienced 25 separate billion-dollar weather disasters, the most since records began.

“This is the most events identified not only for this 10-month period, but also the most events during that single calendar year since we began tracking these records in 1980,” said Karin Gleason, chief of NOAA’s National Centers for Environmental Information (NCEI), during the agency’s monthly report call.

By the numbers: The disaster events have cost $73.8 billion in damages, according to NOAA estimates.

- That’s $22.6 billion above the average cost of damages through October but not close to the record of $360.8 billion in 2017.

The 25 events include:

- 19 severe weather events.

- Two flooding events.

- One tropical storm (Hurricane Idalia).

- One wildfire event.

- One winter storm event.

Why it matters: The cost and frequency of weather events have increased, impacting the insurance market.

- Insured losses from disasters are rising at a long-term rate of between 5% and 7% per year, according to insurer Swiss Re.

- Insurance companies are pulling back on homeowners’ policies nationwide due to the fear of natural disasters and soaring rebuilding costs.

That’s causing many Americans to skip on insurance. They say they can no longer afford the rising premiums.

- Bankrate reported that the national average for home insurance increased 20% this year to $1,428 based on $250,000 in dwelling coverage.

What we’re watching: The year is still ongoing; there could be other potential billion-dollar yet. Severe weather trends will likely push insurance costs ever higher.

Yes, and working with a trusted, experienced insurance advisor is becoming critical.

In today’s evolving insurance marketplace, we at Premier Private Client understand that insurance decisions are complex. We are committed to guiding you through the process.

Contact us today to set up a complimentary Premier Lifestyle Risk Assessment, request information, or speak with an advisor experienced in high net worth insurance solutions.